Description

STEP 2 of the Stall and Stable Business Planning Toolkit

If you are serious about drawing an income from your boarding, training, or service-based horse business, start with this guide that offers detailed instructions about how to write a business plan that can turn your daydream into your day job.

A long-format business plan is the best way to fully define your business so you don’t waste time, energy, or money as you get started. It will also:

- Make you more confident as a business owner.

- Help you understand both your personal and financial needs from the business.

- Help you manage day-to-day decisions, so that the business part of your barn can run as smoothly as possible, allowing you to focus on what you truly love to do.

- And, if you will need financing to get started, a long-format business plan is required by banks, private investors, and sponsors.

This downloadable, 23-page guide provides detailed instructions and examples for each section of a business plan, including:

- How to write a great Executive Summary that will entice clients, investors, and sponsors.

- Creating a detailed description of your business, including identifying key profit centers around your farm.

- Marketing advice, like how to best position your business to your target market.

- How to plan for employees.

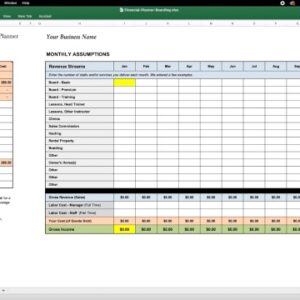

- Financial Projections to help you figure out how much income you can actually make.

- Sample Executive Summary (read all about Arched Arabians!)

To complete your Business Planning Toolkit, our Horse Business Financial Template makes easy work of calculating your projected income and expenses.

R Loucks (verified owner) –

With the Equestrian Business Plan Guide I have been able to modify and edit my business plan to meet the needs of potential lenders and investors. I wish I had this before I met with my local SCORE office, because while they were extremely helpful, they were not knowledgeable of the horse industry. This guide was way more helpful than the folks I interacted with at SCORE. And I didn’t have to drive an hour and a half out of my way. “ 😊